Documentary Review: The Commanding Heights (2002 Documentary)

I just finished watching a documentary series from 2002 called The Commanding Heights based on the book by Daniel Yergin and Joseph Stanislaw. This was a really interesting documentary series that I first learned about from an article on the personal finance website Investopedia. This documentary series is a three-part series that goes through the history of economics from it’s foundation to present day (i.e. the 21st century). Yes, the documentary is super dated because it came out in 2002; I could tell that it was pretty dated because of the music, the advertisements shown, and the people who were interviewed. However, sometimes we can learn a lot from the past and this documentary series is really educational for anyone interested in learning more about economics and global finance. I will summarize my key learnings from each part of the documentary right here.

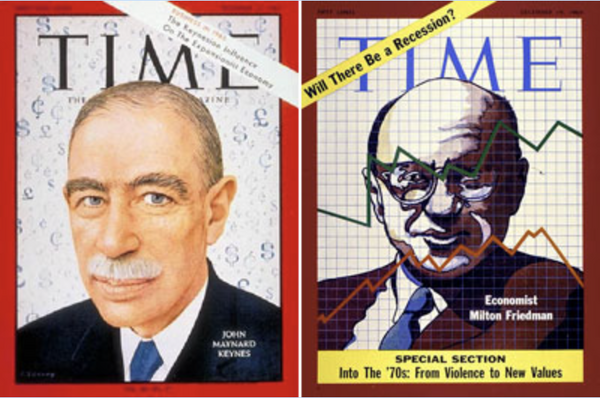

Episode One - The Battle of Ideas

- The rise of John Maynard Keynes and Keynesian Economics led to unchallenged economic principles for most of the 20th century. Governments must spend large sums of money on infrastructure, the welfare estate, and actively manage the economy in order to get people working and foment inflation rise. Even if a government went into debt, that’s ok because spending and big government is what creates a productive, healthy economy.

- This was the most prevalent economic theory among western countries after WWI and WWII.

- However, there was one academic who challenged the notions of Keynesian Economics. Friedrich Hayek from Austria argued for free market economics and letting the markets decide prices, employment levels, inflation, etc. Government needs to get out of the way! Smaller goverment leads to efficiency and productivity.

- Heyek’s ideas were considered radical and he was only able to get an academic job at The University of Chicago.

- For ~30 years after WWII, Keynesian Economics was basically unchallenged around the world. In the U.S., people experienced a kind of material wealth at affordable prices like never before. People were buying homes, cars, appliances, etc. such that for 30 years, times were good. However, the government ran huge deficits during this time and drove up inflation slowly.

- In the 1980s, things started changing after the world experienced global economic declines in the 1970s. The ideas coming out of The University of Chicago that pushed for free markets was growing in influence. There began a change in policy and public discourse as to what’s better: centralized government intervention or free markets as the dominant force in the economy going forward?

Episode Two - The Agony of Reform

- With the election of conservative leaders in the U.S. and U.K respectively, economic policies started to change in the west in the 80s. The leaders of the west were big adherents to the ideas of Hayek and the most famous champion of free markets that ever lived, Milton Friedman (U. of Chicago). In order to combat inflation, governments restricted the amount of money in the system. Tax cuts were implemented to spur economic growth. Things always get worse before they get better, so unemployment in the short term is necessary to make economic gains in the future and reduce the chances of hyperinflation.

- Milton Friedman and the “Chicago School of Economics” had a famous case study when they were brought in to grow the economy of Chile. By embracing free markets, competition, and no central planning, this lead to a transformation in the Chilean economy and led to Chile turning into a democracy. Chile subsequently became the fastest growing economy in Latin America.

- One country that did not adhere to free markets was the Soviet Union. A global superpower in terms of science and technology, the Soviet Union was still a state-run enterprise in pretty much all of it’s economic industries, especially the “commanding height” industries, such as energy, oil, mining, manufacturing, etc. This system worked well when oil prices were high, but terrible when oil prices dropped. Furthermore, inefficiency in state-run enterprises could not spur productivity because there was no competition, therefore sluggishness was the default culture at large. This was a problem. The Soviet Union suffered major economic problems in the 1980s culminating in the fall of the Soviet Union in 1991.

Episode Three - The New Rules of the Game

- In the 90s the world started changing once again. The vast majority of countries started embracing capitalism in the form of free market economics and the world was more integrated than ever.

- Through organization such as the World Trade Organization, the practice of free trade among nations and interconnected economies (i.e. globalization) was becoming the dominant paradigm.

- There are however large and loud forces who believe that globalization is something that only favors the corporations and the plutocrats, leaving the ordinary person behind; this is a very fair point. How do we navigate these challenges?

- With the rise of the internet and telecommunications technologies, the world is now smaller and anyone can become an entrepreneur.

I really enjoyed this documentary series because there are a lot of lessons in here. This was made 20+ years ago and looking back over what I’ve experienced since then, it’s so true that macroeconomic forces has a big part in a person’s life that’s beyond his or her control. There was a story featured in Episode Three of an entrepreneur in Thailand who was not used to capitalism and easy credit. When capitalism came to Thailand, he used leverage to buy multi-tenant apartment buildings that were very lucrative during economic boom times. However when the economy changed, his over-leveraged positions resulted in losses and then the eventual liquidation of all his hard assets. It’s a tough pill to swollow. I guess the biggest takeaway from this documentary is that the world is always changing and it’s never going to stop changing. You can never predict where the economy is going to go, but you know one thing: it’s going to change. The people who get left behind in the global economy are the people who are not learning. As long as you are learning, indentifying new opportunities, and making the most of any opportunities present in front of you, then you should do ok overall.